According to new analysis from Resilience Media and Dealroom, counter-drone systems (more commonly referred to as counter-UAS) remain woefully underinvested as far as venture capital is concerned – particularly in Europe – despite the conflict in Ukraine highlighting the security flaws that both sides are exploiting with regular use of drones for strike, surveillance and electronic warfare missions.

The analysis, which comes as drone incursions into Danish, Polish and Romanian airspace hit the news, finds that:

- Investment in anti-drone systems remains low – just $13 million across four rounds in 2025, to date;

- The shortfall comes despite a surge in investment in UAVs, with $279 million invested across 97 deals. This represents nearly one-fifth of all drone-related investment made since 2019;

- Overall, robotics and autonomous systems have attracted $344 million in 2025, accounting for almost a quarter of the $1.5 billion raised by defence tech companies;

- The United States continues to dominate investment into drones, providing 53% of global drone investment, while Europe accounts for just 25%, strengthening the debate about whether Europe is doing enough to prepare for the rapidly evolving role of drones in both warfare and security.

The figures come from The State of Defence Tech 2025, which has been released as the second Resilience Conference kicks off in the City of London, bringing together leaders from the military, venture capital, and startups working in the defence tech sector.

Ukrainian soldiers speaking at the conference said that forces were only able to intercept about 10% of drones in the battlefield and that technology needed to be developed significantly, to counter bad weather, visibility and the sheer volume of COTS-type drones coming from Russia.

“While drones are transforming defence capabilities with significant investment in 2025, the lack of comparable growth in anti-drone technology highlights a dangerous vulnerability. This technology is still in its infancy and venture capital investors can understand it better by working closely with Ukrainian startups on the ground. Russia’s actions in Ukraine and the recent incursions in other European states in the last fortnight underline the need to invest specifically in counter-drone technology,” commented Tobias Stone, co-founder of Resilience Media.

DA Comment

That drone warfare is here to stay is a certainty – the last two decades have seen UAS take a far more prominent role in the air-land battle. That industry has responded is also a certainty – a casual look at the directory recently published by Unmanned Airspace will confirm that (see our own home page for an announcement of the directory or visit Latest news – Unmanned airspace). However, industry is still unable to ramp up production quickly, in the main for two reasons: first is the undoubted level of under investment identified in the report referenced above. As important, though – if not more so – is the inability or, more accurately, the unwillingness of procurement authorities to specify the scale and nature of future requirements. Industry can react quickly, and venture capitalists can rally to the cause, if there is a viable market evidenced by the acquisition side of the equation.

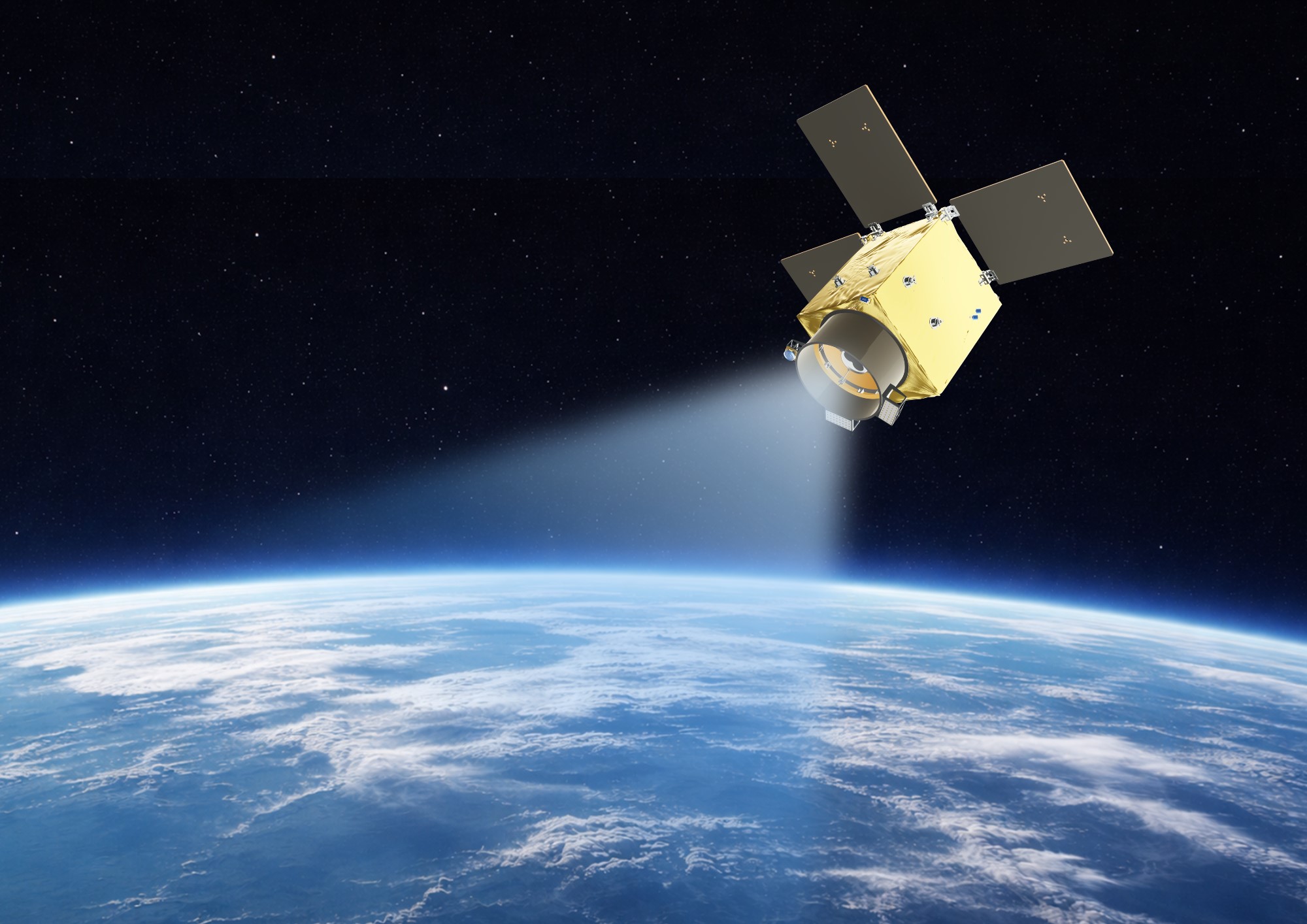

Image: Some authorities have begun to acquire and deploy counter-drone systems – such as the ASUL system from ESG seen here in Bundeswehr service – but very few are procuring at scale. Nor is there any sign of that situation changing in the short term. (Bundeswehr)